Roth Ira Income Limits 2025 Income - Income limits income limits annual contributions. Roth iras have income limits and roth 401(k)s do not. Limits For 2025 Roth Ira Image to u, Single, head of household and married filing separately (didn’t live with a spouse in 2022)

Income limits income limits annual contributions. Roth iras have income limits and roth 401(k)s do not.

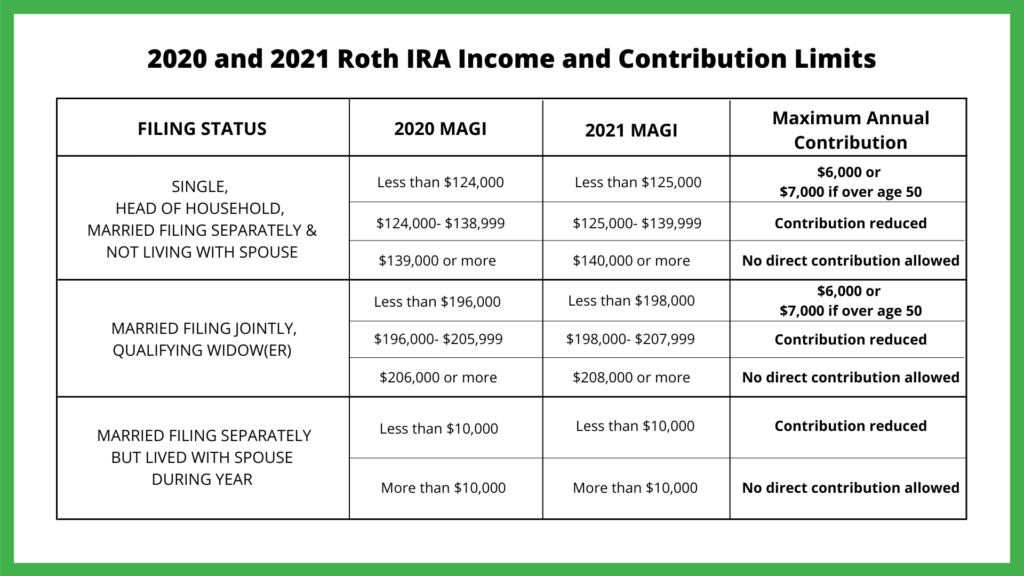

2025 Max Roth Ira Contribution Limits 2025 Clio Melody, To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year).

Magi Limits 2025 For Roth Ira Letta Olimpia, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Limits For Roth Ira Contributions 2025 Gnni Shauna, For 2025, you can contribute up to $7,000 to a roth ira if you're under 50 and your income falls below the threshold.

Roth Ira Limits 2025 Irs, Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth.

2025 Roth Ira Contribution Limits Sybyl Tiertza, Income limits income limits annual contributions.

Limits For Roth Ira Contributions 2025 Gnni Shauna, Single, head of household and married filing separately (didn’t live with a spouse in 2022)

Roth Ira Limits 2025 Married Filing Jointly Karla Marline, For 2025, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2025).

Roth Ira Income Limits 2025 Income. Whether you can contribute the full amount to a roth ira depends on your. The roth ira contribution limit for 2025 is $7,000, or $8,000 if you’re 50 or older.

Max Roth Ira Contributions 2025 Libbi Othella, You’re allowed to increase that to $7,500 ($8,000 in 2025) if you’re.

401k Roth Ira Contribution Limits 2025 Clio Melody, For 2025, a roth ira has a maximum yearly contribution limit of.